This Is Why Prediction Markets Might Be the Only Fix for Today’s Media

If the goal of news media is to inform the public then it is failing

Over half of all adults now regularly get their news from social media while thousands of local news agencies have shuttered. Globally less than 40% of the public even trust traditional news. Prediction markets offer a balance to the editorialized media sources since its event markets financially incentivize accuracy instead of attention.

How did this happen?

Publishers have always made money by entertaining readers in order to sell ads and subscriptions, providing trustworthy news was just one of many methods. What has changed more recently is that social media now owns distribution instead of the content publisher. Audiences no longer choose outlets directly, editorial vetting has been replaced by engagement‑ranked algorithms that are not held to the same journalistic standards and libel laws.

As the curated content matches consumer’s taste they are increasingly split into their own ‘filter bubbles’ and end up with different sets of facts than others who could be in their own communities. Along with polarization, this breeds a mistrust of content outside of each media bubble.

How do markets fix this?

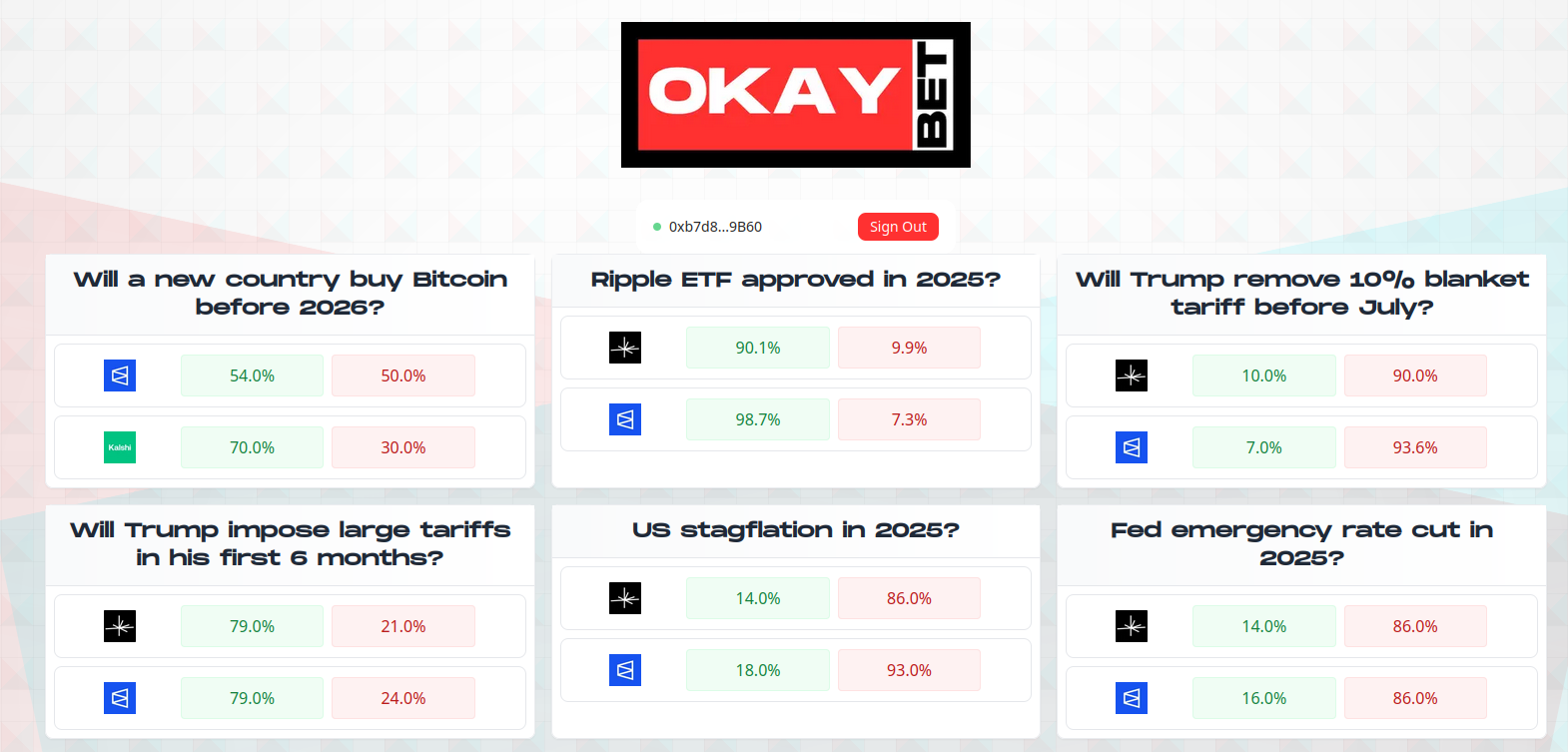

A bet is a tax on bullshit and prediction markets offer a way for people to be rewarded or punished for their perspective. In the aggregate, people betting on events end up making really good predictions on what will actually happen due to price discovery. This means prediction markets can be used to give a better forecast for the future than merely reading news stories can provide. These information markets can be used as a standard for the public to vet their news.

How could this actually work?

The main benefit in becoming informed on current events is that it helps in planning for the future. Just as a weather forecast informs what outfit to wear, a recession forecast could tell someone to how to manage their money, and an election forecast could inform what policies to expect. While predictions markets will absolutely not replace media content, it will be an incredible source of simple fact checking. One can imagine using this to check on hyperbolic news events.

If one watches a video that ‘the economy is crashing’ while the price for such a market gives it marginal odds then viewer has two options: either they can believe the market and discount their media source or they can trust their new information and bet against the market. After a few iterations of handling media in this way, the viewer would have valuable financial feedback on what sources are accurate or merely entertaining.

Don’t just read news, be news

When you place a profitable trade the market is effectively paying you for your insightful and smart opinion (the reverse is also true!). If you think you have the right information, consider using Okay Bet to find the prediction markets with the best price!